Virtual Family Office: A Practical Guide

By Varun Bodhi

Table of Contents

1. What is a virtual family office?

1.1. Definition and scope

1.2. How VFOs work in practice

2. The rise of the virtual family office

2.1. Why families are moving to VFO models

2.2. Signals that the model fits your situation

3. Traditional and virtual family offices: key differences

3.1. Service coverage comparison

3.2. Trade-offs, risk controls, governance

4. Core services a VFO typically provides

4.1. Reporting, coordination, and oversight

4.2. Tax, accounting, and administration

5.1. Outsourced versus hybrid coordination

5.2. Vendors, platforms, and operating workflows

6.1. Selection checklist

A virtual family office model gives you coordination without building a permanent internal team. Rather than hiring every function, you appoint a small lead layer that keeps advisers aligned and keeps decisions moving. For a virtual family with several entities or jurisdictions, the operating discipline matters more than headcount.

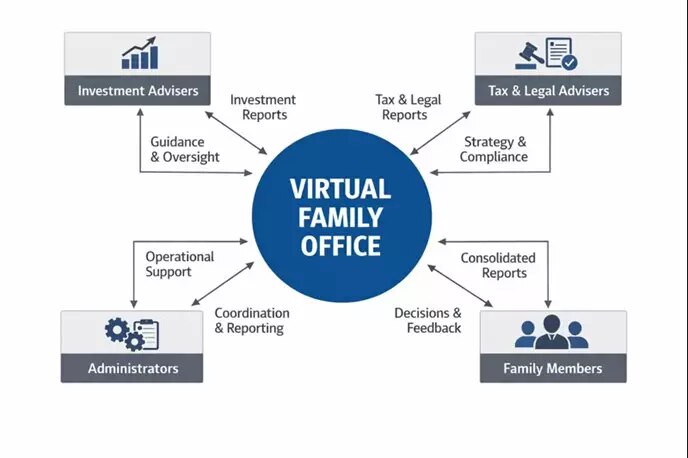

You will often see the acronym VFOs used for this approach, short for virtual family offices. A virtual family office is best thought of as a coordination and oversight layer, with delivery handled by selected specialists. It suits virtual family decision-making when information is spread across providers and accountability needs to be clearer.

What is a virtual family office?

Definition and scope

A virtual family office is an operating arrangement where oversight stays centralised whilst specialist work is delivered by a chosen network. Compared with a single family office, it relies less on internal staffing and more on a clear operating structure.

In practice, the scope is shaped by the family. For wealthy families, it often includes consolidated reporting, administration oversight, and routines that support family governance. It can also reduce the need for dedicated family office space whilst keeping the operating view consistent. They are part of the overarching umbrella of family office services that high-networth families search for.

How VFOs work in practice

VFOs run on cadence. Decision rights are written down, reporting follows a set rhythm, and owners are named for each workstream. The workstreams usually cover investment management oversight, tax inputs, administration, and risk controls, but the emphasis is on who owns the outcome.

The coordinating lead pulls updates into one view and checks that requests are complete before anything goes for approval. That makes it easier for family members to sign off quickly. In a virtual family setting, the benefit is fewer loose ends and less duplicated work.

The rise of the virtual family office

The rise of the virtual family office is tied to practical pressure. Families now deal with more entities, more reporting requirements, and advisers spread across time zones. Even in a virtual family, those moving parts still need a single operating view.

Many also want tighter control around family wealth without committing to permanent headcount. With the right coordination layer, a virtual family can scale support for major events, then return to a steadier run rate once the pressure drops.

Example: A family has a trading company, property held in separate vehicles, and adult children living overseas. They keep the same accountant and adviser, but introduce a coordinating lead who standardises reporting and runs an approvals calendar. For day-to-day logistics, they may also use an on-demand base for mail handling and scheduled meetings.

In Singapore, the address can matter more than people expect. It affects how documents are routed, where couriers deliver, and how counterparties verify details. Using a provider like Servcorp Singapore keeps that point of contact consistent. Servcorp’s Marina Bay Financial Centre location is at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983.

Why families are moving to VFO models

Some wealthy families have outgrown informal coordination but do not want to build a traditional family office. Others have used a multi family office and prefer a set-up where they can choose each specialist whilst keeping oversight close.

For a virtual family, the model also fits modern dynamics. When family members are spread across countries, the same structure can support wealth management and recurring administration. It also makes succession planning easier to keep current, because the actions and documents are tracked rather than left to drift.

Signals that the model fits your situation

These signals often show up in a virtual family before the need is formally acknowledged:

-

Reporting arrives in different formats, or at inconsistent times

-

Decisions stall because no one owns follow-up end-to-end

-

Approval rights are unclear across family members and entities

-

You want better monitoring of investment management without changing managers

-

You need dependable administration and occasional concierge services, but not full-time staff

Traditional and virtual family offices: key differences

Service coverage comparison

Traditional and virtual family offices solve the same problem in different ways. A traditional family office is built around a permanent team, often paired with dedicated family office space. A virtual family structure keeps a lean coordination layer and sources delivery through providers.

Some families compare a multi family office to a virtual option. A multi family office can be strong for packaged delivery. The virtual family approach can be more flexible, provided accountability is controlled and outputs are standardised.

Coverage usually looks like this:

-

Investment management: internal monitoring versus coordinated external managers and reporting

-

Administration and accounting: in-house staff versus managed delivery through firms

-

Family office services: bundled service lines versus selected providers with standard tracking

-

Concierge services: handled internally versus sourced support when needed

Trade-offs, risk controls, governance

The core trade-off is accountability. A traditional family office can reduce coordination risk because roles sit inside the organisation, but it adds hiring and internal controls to the workload.

A virtual family structure can reduce fixed overheads, but it relies on process discipline. Family governance becomes the safeguard. Decision rights, escalation paths, and reporting standards need to be explicit, particularly when family members are in different places.

Controls work best when approvals are documented and records are kept consistently. That is what supports private wealth management without gaps.

Core services a VFO typically provides

Reporting, coordination, and oversight

The first of the core services is a reporting pack that stays consistent. It consolidates cash, assets, liabilities, entity activity, and key actions so family members are not chasing updates across advisers.

Coordination sits behind the pack. The lead runs the meeting rhythm, follows up owners, and closes the loop on actions. In a virtual family environment, this prevents quiet gaps where work sits with no clear next step. It also supports wealth management decisions because information is comparable month to month.

Tax, accounting, and administration

Tax and accounting can be delivered by existing firms, but managed through a single operating view. Requests go to the right party, deadlines are tracked, and outputs are stored in one place.

This is where family office services expand beyond compliance. It can include payments, entity maintenance, document control, and recurring admin. It also helps keep succession planning inputs current rather than treated as a one-off project.

When a virtual structure needs an address for correspondence and records, the details matter more than most families expect. Consistency helps with mail handling and a clean trail for notices and signed documents. For example, families coordinating activity in Singapore may use Servcorp Singapore at Level 39, Marina Bay Financial Centre Tower 2, 10 Marina Boulevard, Singapore 018983 for mail handling and meeting space, whilst keeping delivery work distributed across advisers.

Controls and data security

Controls should match how approvals happen day to day. Clear signatory rules and authority limits reduce avoidable risk, particularly for a virtual family with signatories in different locations.

On the data side, use role-based access and secure storage, backed by an audit trail. Strong controls protect speed and confidentiality.

Model options for VFOs

Outsourced versus hybrid coordination

Most structures sit on a spectrum. One end is fully outsourced coordination where the lead runs reporting, meetings, and follow-ups. A hybrid option keeps coordination external and assigns an internal point of contact for approvals.

For some wealthy families, a hybrid can provide continuity without moving straight into a single family office build.

Vendors, platforms, and operating workflows

The work is less about tools and more about workflow. Agree the reporting format, define owners, and set an escalation path when deadlines slip. Platforms should support secure document storage, permissioned access, and a record of changes.

If you already use several firms for wealth management and related family office services, write responsibilities down and review them on a schedule.

Implementing the model

Selection checklist

Start by defining what the coordination layer owns, then confirm who delivers each piece:

-

One lead with authority to consolidate reporting and chase actions

-

A reporting cadence with basic quality checks

-

Documented decision rights for family members

-

Clarity on investment management monitoring and sign-off

-

A simple family governance rhythm for meetings and minutes

-

Defined family office services scope, including concierge services where needed

-

Succession planning inputs owned and reviewed

-

Data access rules and provider offboarding steps

Implementation steps and common pitfalls

-

Map providers and entities, including deadlines and approval routes

-

Set the reporting pack format and cadence

-

Document decision rights and escalation paths

-

Establish workflows for requests, actions, and closure

-

Put controls in place before volume increases

In practice, the best results come from keeping the model simple. Traditional and virtual family offices differ most on accountability and operating discipline. When governance routines are consistent, a virtual family office model can support wealth management without adding unnecessary overhead.